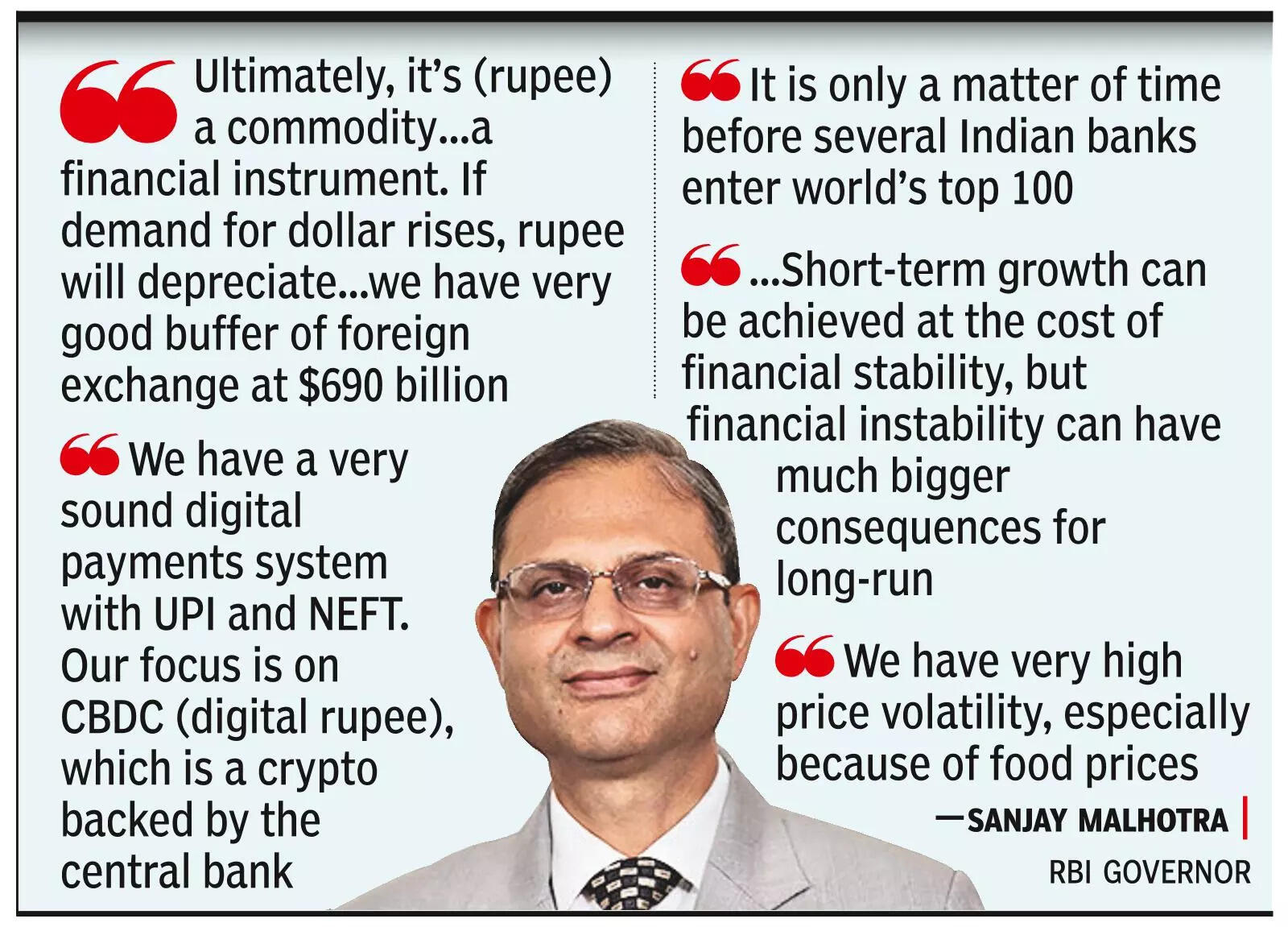

NEW DELHI: RBI governor Sanjay Malhotra said on Thursday that the central bank does not aim for any particular level for the rupee, and depreciation of rupee is driven purely by market demand, with recent depreciation linked to tariffs. “We do not target any level for the rupee,” Malhotra said at an event at the Delhi School of Economics. “Ultimately, it’s a commodity…a financial instrument. If demand for the dollar rises, the rupee will depreciate. Recent movement is linked to trade expectations and muted capital flows, but we are quite confident a good trade deal will happen soon, and we have very good buffer of foreign exchange at $690 billion,” he added.

.

Malhotra also said RBI remained “very cautious” on cryptocurrencies because of its risks, while pushing for their own digital rupee (CBDC) for domestic and cross-border payments. “We have a very sound digital payments system with UPI and NEFT. Our focus is on CBDC, which is a crypto backed by the central bank,” he said, adding that govt and its working group will take the final call on the policy framework for crypto. He also responded to a question on Indian banking expansion to the international stage, saying that India did not have a “target number of banks” to become big, but rapid economic growth and rising bank balance sheets meant “it is only a matter of time before several Indian banks enter the world’s top 100”.The rupee has continued its slide since the US imposed a 100% tariff on many exports in Oct 2025, prompting risk-averse investors to cut exposure. The currency has lost 3.5-3.6% against the dollar since Aug and has traded near record lows around Rs 88.7/$ after intraday fall of up to 0.7%. A stronger dollar, firmer crude and broader Asian currency weakness have compounded the pressure. RBI has stepped in to prevent a steeper drop, keeping the rupee in a narrow band, but traders warn that a breach of Rs 89/$ could force more aggressive intervention.