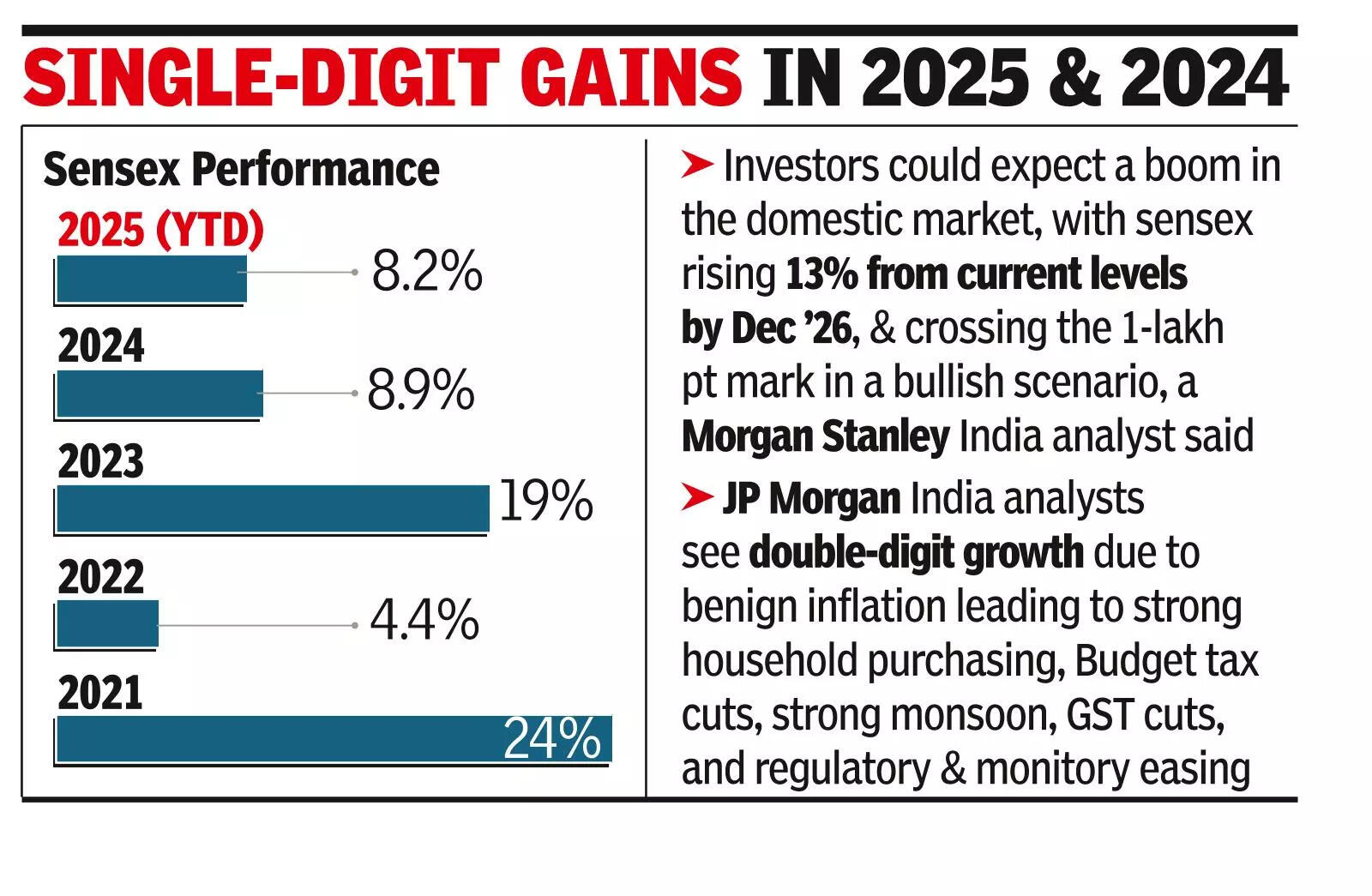

MUMBAI: What’s in store for the Indian markets and the corporates in 2026? As the year 2025-marked by high volatility and single-digit returns for sensex and Nifty-nears its end, brokerages and analysts are queuing up to come out with their predictions and expectations for the coming year.Analysts and strategists from a host of foreign and Indian brokerages are bullish on India, with most listing the govt’s policy support for the economy as one of the key catalysts, with external factors as a major risk for India. One of the top monitorables for the Indian economy in the coming year would be the impact of the recent GST rate cut on the economy.Recently, Morgan Stanley India’s Ridham Desai said that Indian investors could expect a strong bounce in the domestic market with sensex rising about 13% from current levels by the end of Dec 2026. Desai sees a 13% upside in sensex through Dec 2026, translating to about 96,000 points for the index. And in a bull-case scenario, sensex could cross the 1-lakh-point mark next year.

In a note, Morgan Stanley analysts led by Desai said they see Indian equities regaining their mojo in 2026 as the long-term story is gaining strength with govt policy action, and the cyclical recovery is backed by policy pivot. “Most risks to our views come from outside India,” the report said.Rajiv Batra of JP Morgan India is expecting accelerated double-digit growth in corporate earnings in the second half of the current fiscal, which would spill over to fiscal 2027. Batra’s expectations are based on the better-than-expected numbers that India Inc announced during the July-Sept quarter. Analysts at JP Morgan India “see a confluence of factors like benign inflation boosting household purchasing power, another strong monsoon, direct tax cuts in the Budget, GST cuts, and monetary and regulatory easing.“For Citi India’s Surendra Goyal, there are a few monitorable factors for the Indian economy and the markets in 2026. Festive season demand saw an uptick but remains to be seen if the momentum sustains, Goyal wrote in a strategy note for India. “Update on the US-India trade deal and confidence on return to double digit earnings trajectory in FY27 remain key,” Goyal said.According to Mahesh Nandurkar at Jefferies India, the sustainability of the GST-driven consumption uptick is key for a stronger earnings trajectory for the Indian market.For Seshadri Sen and his team at Emkay Global, the top of their expectations list is an earnings recovery in the current half of the fiscal, which could come on the back of consumption bounce-back. They expect Nifty to reach the 28,000-point mark by Sept 2026, translating to a gain of about 8% from Wednesday’s close for the index.